The global game industry in 2025 is no longer driven by scale – it is driven by efficiency and retention.

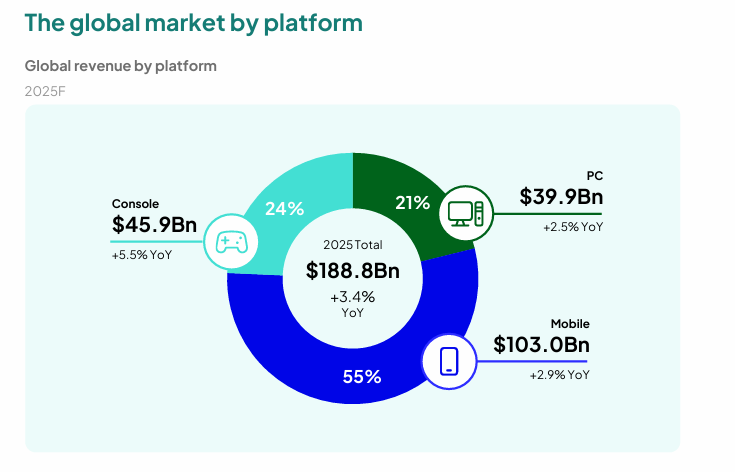

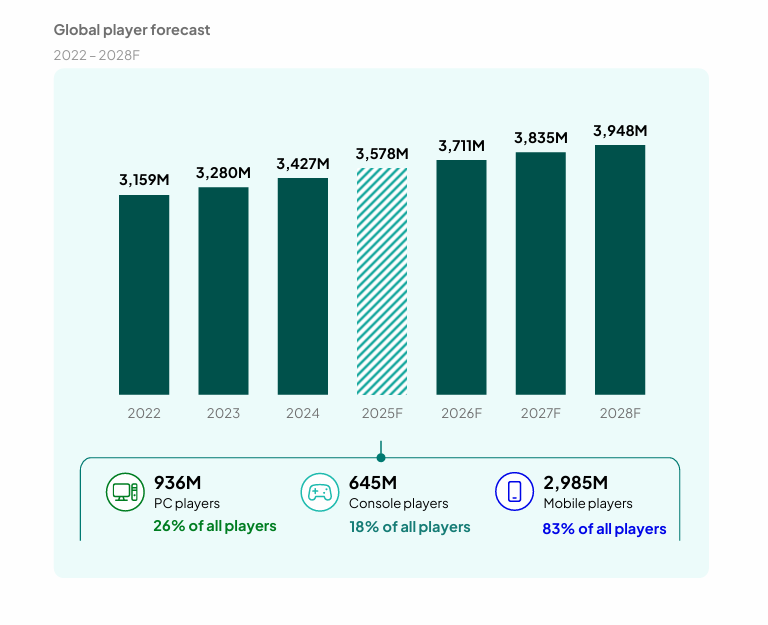

According to Newzoo’s 2025 Global Games Market Report, the industry will reach $188.8 billion in total revenue in 2025, representing +3.4% year-over-year growth, while the global player base expands to 3.6 billion players (+4.4%). On paper, the market continues to grow.

But under the surface, the rules of game development have changed:

- Player growth is slowing relative to online population growth

- Player growth now outpaces revenue growth

- Average spending per payer is flattening or declining

- Discoverability has become a systemic bottleneck

This is no longer a market where “more content” or “bigger launches” guarantee success.

The game industry in 2025 quietly admitted maturity.

2026 will be the year studios are forced to adapt how they build or fail to scale.

This report distills what the 2025 data is really saying beyond the optimistic headline and what it means for studios heading into 2026. Not what might change, but what has already stopped working. As a game development company working hands-on with studios across Japan, Asia, and global markets, GIANTY isn’t analyzing this from a distance; we’re rebuilding how games are made to survive what comes next.

Market Growth Has Become Selective in the Game Industry in 2025

Newzoo’s data confirms that the games market is still growing, but growth is harder to capture.

Key game industry in 2025 projections:

- Nearly 3.6B global players, representing over 61.5% of the online population

- All platforms are growing at low-to-moderate rates (2–6% YoY)

- Continued revenue resilience across PC, console, and mobile

However, a critical signal emerges: More people are paying for games, but total spending is not increasing at the same pace.

This indicates a shift in player behavior:

- Spending is more intentional

- Value expectations are higher

- Players are consolidating time and money into fewer titles

Platform Dynamics in 2025: Why PC and Console Are Regaining Strategic Weight?

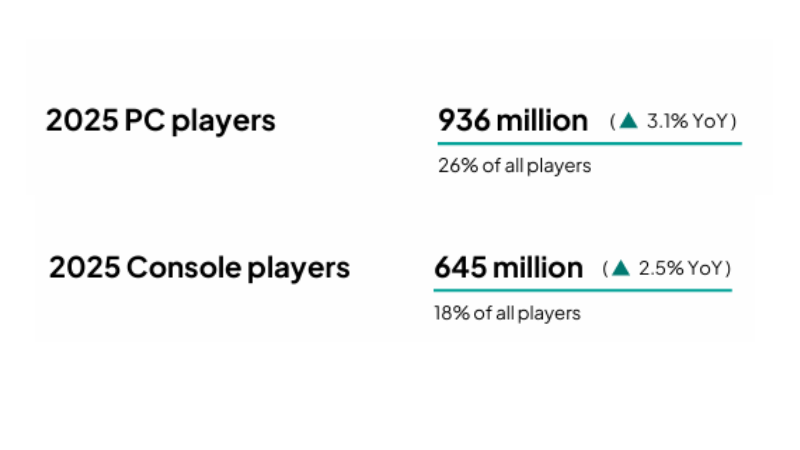

- PC and console are regaining strategic importance, with PC player growth outpacing both mobile and console in multiple markets, according to Newzoo.

- Cross-platform releases are reshaping competition, increasing baseline expectations for availability across PC and console.

- New hardware cycles continue to support console engagement and ecosystem stability.

- Anticipation of major premium titles like GTA VI is driving player reactivation and renewed attention to high-end platforms.

For studios, this matters because PC and console environments increasingly favor:

- Longer session times

- Stronger post-launch engagement

- Higher responsiveness to updates and expansions

What Are the Strategic Implications for Game Studios in 2026?

- You cannot rely on new players to save a weak product

- Retention, re-engagement, and long-tail monetization now matter more than launch spikes

- The era of “launch and move on” is effectively over

In a selective market, relying on one platform is no longer just a design choice – it’s a business risk. So game porting has changed from “afterthought” to “survival plan”.

How Should Studios Build Their Next Game in 2026?

The data from the game industry in 2025 makes one thing clear: studios heading into 2026 cannot rely on momentum, market growth, or launch hype alone. Games that succeed will be the ones designed for longevity, flexibility, and sustained player value from the very beginning.

Below are the three strategic pillars that should shape how studios plan, build, and operate their next title.

Use Remakes and Remasters as Strategic Growth

Remakes and remasters are no longer seen as low-effort projects. Due to the game industry in 2025, they have become a proven strategy for extending franchise lifecycles and stabilizing revenue.

For studios and publishers, classic IPs offer:

- Built-in brand recognition and trust

- Lower user acquisition friction

- Clear audience expectations

When executed well, remakes and remasters:

- Reintroduce legacy IPs to new platforms and generations

- Modernize visuals, performance, and quality-of-life systems

- Create opportunities for additional DLC or live updates

However, the key shift for 2026 is intent. Successful remasters are not treated as standalone releases, but as platforms for renewed engagement, often serving as:

- Entry points for new players

- Re-engagement moments for long-time fans

- Foundations for future sequels or expansions

Studios that treat remakes as purely technical exercises risk missing their full commercial and strategic value. A recent example is Tomb Raider: Legacy of Atlantis. As we noted in our Game Awards 2025 report, the remake quickly became one of the most anticipated titles heading into 2026. The interest goes beyond nostalgia – players are responding to how the game modernizes a familiar IP while preserving its core identity.

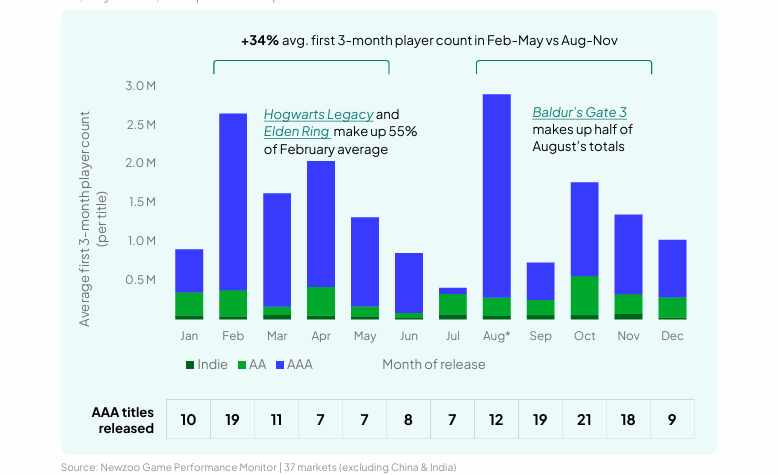

Release Timing Is Not a Marketing Detail

One of the clearest and most actionable signals in the 2025 data concerns release timing. What was once treated as a publishing decision has become a material performance driver.

The Game Industry in 2025 shows:

- Games released February – May achieve ~34% higher early player engagement than titles released August – November.

- Q3 – Q4 releases increasingly cannibalize each other due to market oversaturation, reducing visibility even for high-quality games.

- As a result, the traditional holiday release strategy is actively hurting many titles, rather than helping them.

Why does the holiday window underperform?

- Release stacking across major publishers compresses attention into a narrow timeframe.

- Marketing noise overwhelms storefront algorithms, limiting organic discoverability.

- Players delay purchases, waiting for reviews, patches, discounts, or seasonal sales.

What does this mean for Studios in 2026?

For studios planning releases in 2026, timing can no longer be an afterthought. Release strategy must be:

- Defined during product planning, not finalized at the publishing stage.

- Evaluated against competitive density.

- Coordinated with post-launch content calendars, ensuring that launch is the beginning of sustained engagement, not a one-off event.

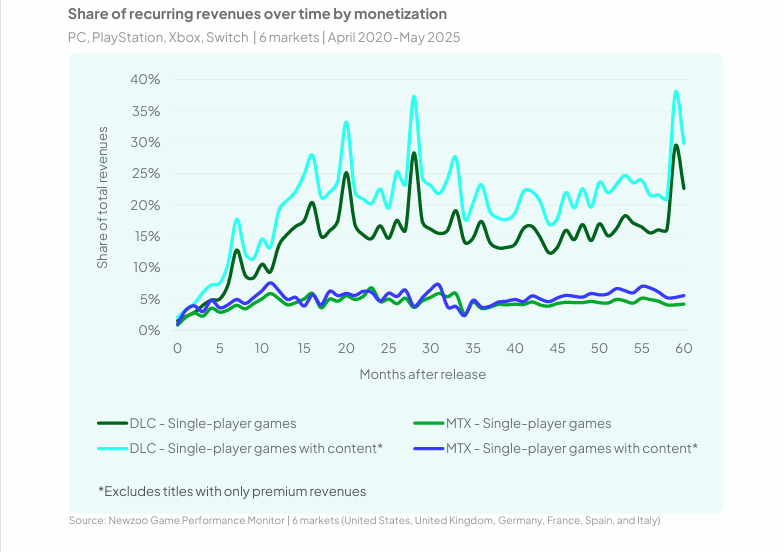

Design for Post-Launch Content and Long-Tail Monetization From Day One

The Game Industry in 2025 shows:

- Post-launch content has become a material revenue driver, not a secondary monetization layer.

- Industry data shows that DLC (Downloadable Content), expansions, and live updates contribute ~20–25% of total lifetime revenue after Year 1 for supported titles.

- Most player churn happens within the first 4–8 weeks, making post-launch engagement critical to stabilizing the player base.

- Games with ongoing content updates demonstrate longer lifecycles and more resilient revenue curves than launch-only releases.

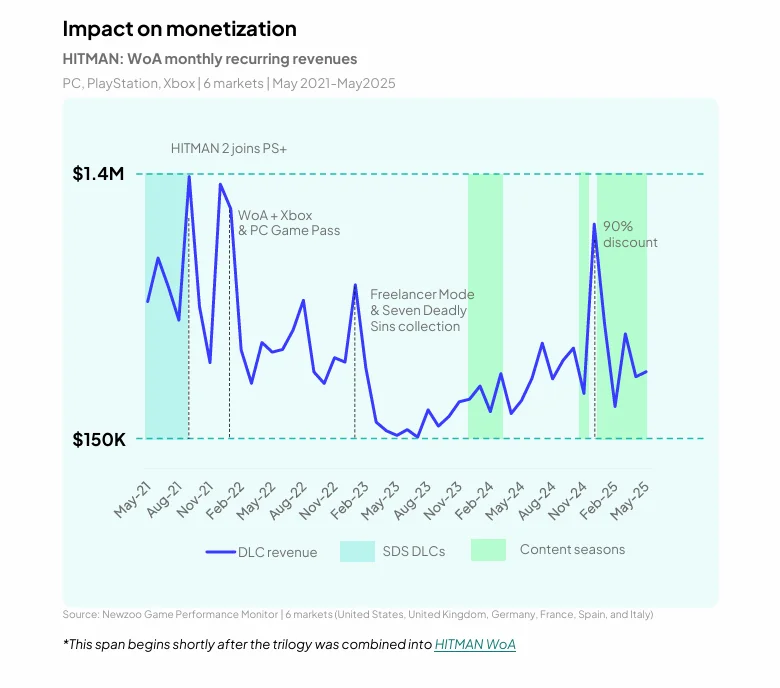

HITMAN: World of Assassination shows how a well-designed post-launch strategy can turn a single-player title into a long-term business, driving stable engagement and generating $150K–$1.4M in monthly DLC revenue, with nearly 80% of players returning rather than churning.

Why Is This Shift Happening?

- The market has become highly selective, with players consolidating time and spending into fewer games.

- Rising development costs make one-time launch revenue increasingly risky.

- Live games, long-running titles, and updated remasters continue to compete for attention years after release.

- Players now expect games to evolve, not remain static after launch.

What This Means for Studios in 2026?

- Post-launch content must be planned before production begins, not retrofitted after release.

- Games should be built with modular systems that support DLC, expansions, and live updates without heavy rework.

- Studios need a 12–18 month post-launch roadmap tied to retention and monetization goals.

- In 2026, games designed as fixed, one-off products will struggle to compete with titles built as long-term platforms.

Final Thoughts: Why Scaling Games in 2026 Is a Systems Challenge

The modern game industry in 2025 has never been easier to enter and never been harder to scale.

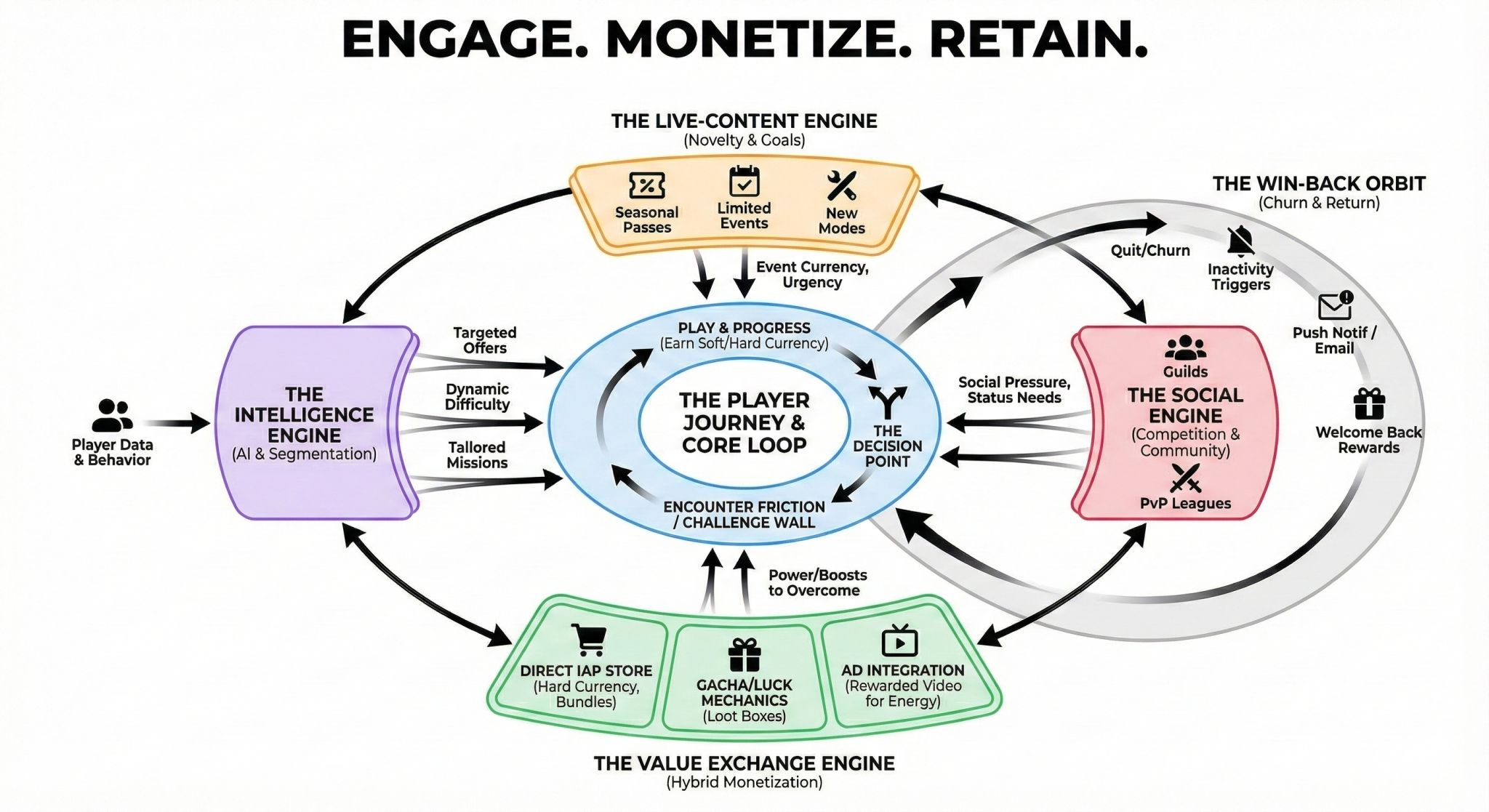

This diagram captures that reality perfectly.

In 2025, building a playable game is no longer the hard part. Engines, tools, assets, and distribution are widely accessible. What separates sustainable games from short-lived releases is everything around the core loop. The core loop still matters, but it is no longer enough.

What successful games now require is a multi-engine system that keeps players engaged, monetized, and retained over time. Here’s how each part of this diagram maps directly to the realities revealed by 2025 industry data.

- The core loop gets players in, but does not keep them there

- Intelligence engines (data and AI or AI Agent) are required to understand behavior and prevent churn

- Live-content systems turn launch into the start of an engagement cycle, not the peak

- Social layers create stickiness through shared experience and community

- Hybrid value exchange models stabilize revenue across different player segments

- Win-back loops extend player lifetime value in a mature, selective market

In 2026, studios that build games as interconnected systems will scale. Those that ship one-time products will struggle to endure.

The GIANTY Perspective: Building Games for the Full Lifecycle

By the end of 2025, we believe the biggest challenge studios face going into 2026 is not creativity or ambition, but sustainability across the entire game lifecycle.

The 2025 data reinforces what we see in practice: great ideas and strong launches are no longer enough. Games succeed when they are designed, built, and operated as long-term systems, not as one-time projects. That belief shapes how we approach game development end to end.

If you’re planning a title for 2026 and beyond – and want to:

- Build scalable, full-cycle game development and live-operation systems

- Design for post-launch content from day one

- Plan release timing, platform strategy, and porting more strategically

GIANTY is open to that conversation. From early planning to live operations, we work with studios to build games that are designed to last.

Looking ahead to the next trends in gaming? Subscribe to the GIANTY newsletter for expert insights and updates.